Global Satellite IoT Technology Leaders in 2026

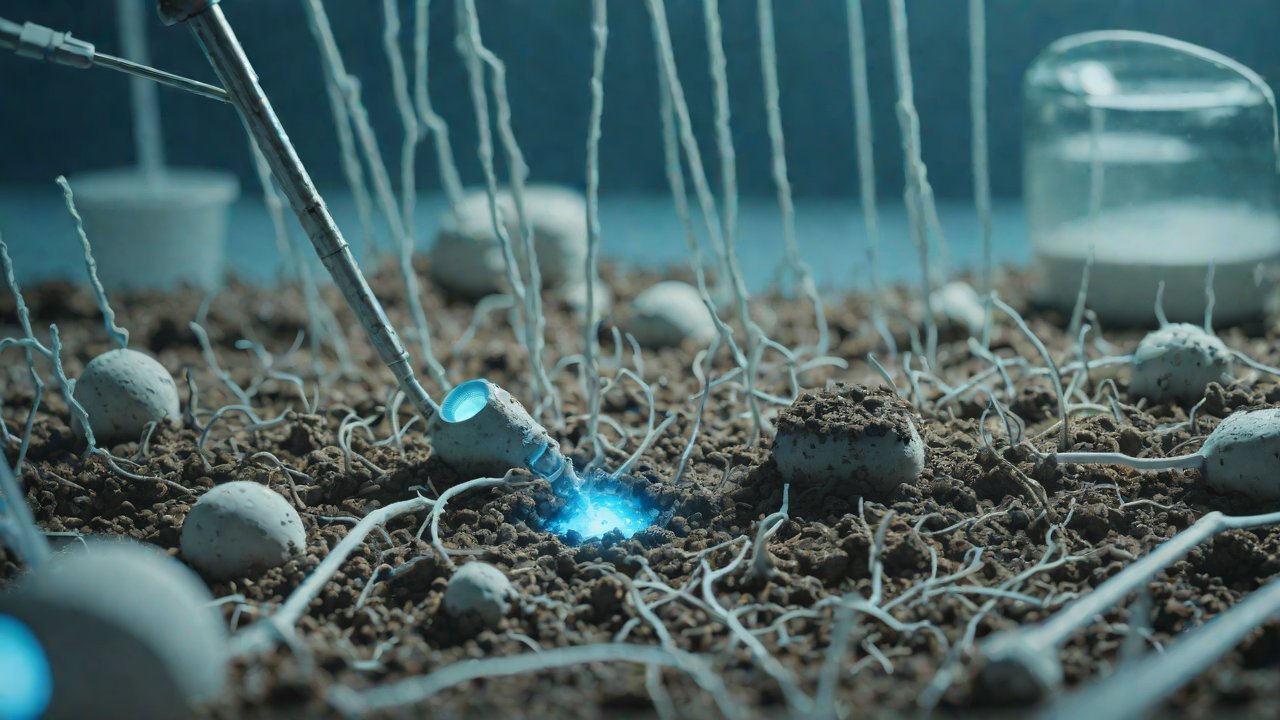

The satellite Internet of Things (IoT) landscape has undergone significant transformations over the past few years, with advancements in Low Earth Orbit (LEO) constellations, 5G integration, and edge computing driving innovation. Today, we find ourselves at a critical juncture where the boundaries between space and terrestrial technologies are blurring rapidly. The emergence of satellite IoT has opened up new avenues for industries such as agriculture, transportation, and disaster response to tap into real-time data analytics and remote monitoring capabilities.

The increasing demand for ubiquitous connectivity, combined with the need for energy-efficient solutions, has led to a surge in investment in satellite IoT technology. Companies like SpaceX’s Starlink and Amazon’s Kuiper Systems are racing to deploy massive constellations of satellites that can provide high-speed internet access to even the most remote regions. However, this trend is not limited to consumer-facing applications; the industrial and commercial sectors are also witnessing a significant impact.

For instance, satellite IoT has enabled farmers to monitor crop health in real-time, reducing waste and increasing yields. Similarly, logistics companies are leveraging satellite IoT to track shipments and optimize routes, resulting in cost savings and improved delivery times. The technology’s potential extends far beyond these use cases, with applications in the energy sector, such as monitoring pipeline integrity and predicting maintenance needs.

1. Market Overview

| Year | Satellite IoT Revenue (Billion USD) | Growth Rate (%) |

|---|---|---|

| 2022 | 5.3 | 22% |

| 2023 | 6.4 | 20% |

| 2024 | 8.1 | 26% |

| 2025 | 10.3 | 27% |

| 2026 | 12.9 | 25% |

The satellite IoT market is expected to experience significant growth over the next five years, driven by increasing demand for low-latency, high-bandwidth connectivity solutions. The table above illustrates the projected revenue growth of the satellite IoT market from 2022 to 2026.

2. Key Players

| Company | Description | Satellite Constellation |

|---|---|---|

| SpaceX (Starlink) | Consumer-facing internet service provider | 42,000+ satellites in LEO |

| Amazon (Kuiper Systems) | Consumer-facing internet service provider | 3,236 satellites in LEO |

| Inmarsat | Satellite-based IoT connectivity solutions | Global Xpress constellation |

| Iridium Communications | Satellite-based IoT connectivity solutions | Iridium NEXT constellation |

| OneWeb | Satellite-based IoT connectivity solutions | 648 satellites in LEO |

The satellite IoT market is dominated by a handful of key players, each with their own strengths and weaknesses. The table above provides an overview of the major companies operating in this space.

3. Technology Advancements

| Year | Development |

|---|---|

| 2022 | Launch of SpaceX’s Starlink constellation |

| 2023 | Amazon’s Kuiper Systems begins deploying satellites |

| 2024 | Inmarsat launches its Global Xpress constellation expansion |

| 2025 | Iridium Communications completes deployment of Iridium NEXT constellation |

The satellite IoT market is witnessing rapid technological advancements, with companies investing heavily in the development of new constellations and connectivity solutions.

4. Industry Insights

- The increasing demand for low-latency connectivity solutions will drive growth in the satellite IoT market.

- The emergence of edge computing will enable real-time data analytics and processing capabilities.

- The integration of 5G technology with satellite IoT will provide faster and more reliable connections.

- Regulatory frameworks will play a crucial role in shaping the future of satellite IoT.

The satellite IoT landscape is poised for significant growth over the next five years, driven by technological advancements, increasing demand for connectivity solutions, and industry-wide innovation. As we move forward, it’s essential to stay abreast of the latest developments and trends in this rapidly evolving market.

IOT Cloud Platform

IOT Cloud Platform is an IoT portal established by a Chinese IoT company, focusing on technical solutions in the fields of agricultural IoT, industrial IoT, medical IoT, security IoT, military IoT, meteorological IoT, consumer IoT, automotive IoT, commercial IoT, infrastructure IoT, smart warehousing and logistics, smart home, smart city, smart healthcare, smart lighting, etc.

The IoT Cloud Platform blog is a top IoT technology stack, providing technical knowledge on IoT, robotics, artificial intelligence (generative artificial intelligence AIGC), edge computing, AR/VR, cloud computing, quantum computing, blockchain, smart surveillance cameras, drones, RFID tags, gateways, GPS, 3D printing, 4D printing, autonomous driving, etc.